If you are a regular seller on the Government e-Marketplace (GeM), you have likely encountered the term ePBG during order execution. In 2026, the portal has moved away from manual checks, relying heavily on integrated banking frameworks like NeSL and SFMS.

Because of this, understanding ePBG in GeM is no longer optional—it is a critical requirement for handling high-value government orders. At Bidz Professional, we’ve seen brilliant sellers lose contracts simply because they didn’t know how to map their bank guarantee digitally. This guide is here to ensure that doesn’t happen to you.

What is ePBG in GeM?

The ePBG full form is Electronic Performance Bank Guarantee.

In the traditional world of government tendering, a “Performance Security” was a physical piece of paper issued by a bank that you had to courier to the department. If it got lost in the mail or sat on a desk for weeks, your payment got stuck.

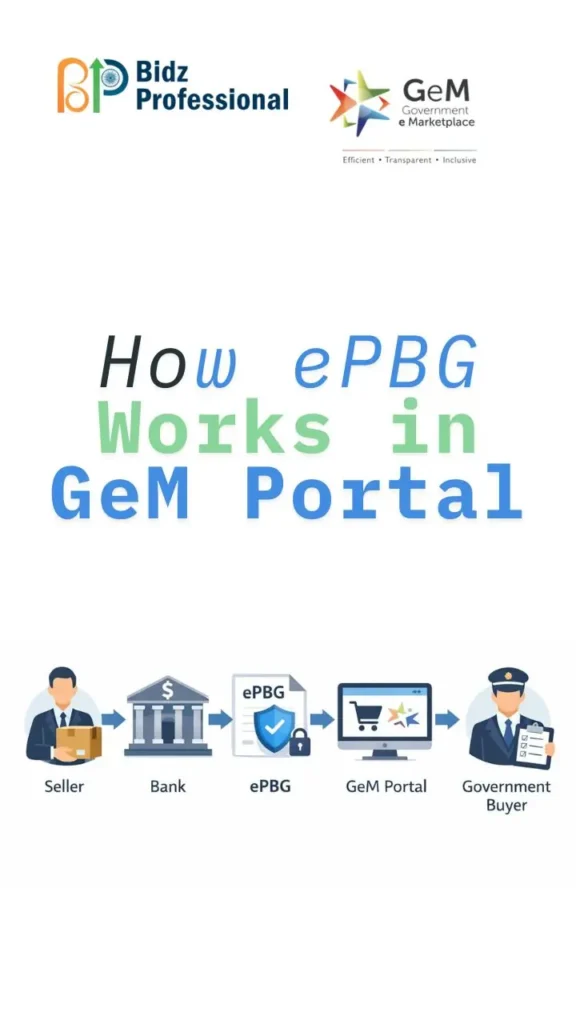

On the GeM portal, this is now 100% digital. An ePBG is a digital commitment from your bank to the buyer. It acts as a promise: if you deliver the goods according to the contract, the guarantee stays safe. If you fail, the bank pays the buyer to cover the loss.

Key Characteristics You Need to Know:

- Post-Award Task: You only deal with ePBG after you win the order (unlike EMD, which is for the bidding stage).

- Standard Amount: Usually between 3% to 10% of the total contract value.

- Extended Validity: It must cover your delivery time + the warranty period + a “claim period” (usually an extra 60 days).

Why is ePBG Used?

Government departments use public money, so they need a “financial shield.” The ePBG serves three main goals:

- Accountability: It ensures you remain committed to the quality and timelines mentioned in the bid.

- Risk Mitigation: If a vendor stops responding or provides faulty products, the buyer can “invoke” the guarantee to recover damages without a legal battle.

- Fraud Prevention: Digital guarantees are much harder to forge than paper ones, making the whole marketplace safer for honest sellers.

Difference Between EPBG and EMD

New sellers often mix these two up. Here is a quick breakdown to keep your records straight:

| Feature | EMD (Earnest Money) | ePBG (Performance Guarantee) |

| When to Submit | During the Bidding Stage | After Winning the Contract |

| Purpose | To prove you are a serious bidder | To ensure you fulfill the work order |

| Refund Timing | After the bid is awarded | After the warranty expires |

| Typical Amount | 2% to 5% of Bid Value | 3% to 10% of Contract Value |

How to Get an ePBG: The 2026 Step-by-Step Process

The process is now highly automated through NeSL (National E-Governance Services Limited) and SFMS.

Step 1: Analyze the Bid Document

Before bidding, read the Additional Terms and Conditions (ATC). It will tell you the exact percentage required. Don’t wait until you win to check if your bank can issue this amount!

Step 2: Accept the Award of Contract (AoC)

When you are declared the L1 bidder and receive the order, click “Accept” on your GeM dashboard. This triggers the ePBG window.

Step 3: Generate the Request Document

In your ‘Orders’ tab, you’ll find a “Request ePBG” link. This generates a form with a Unique Contract ID and the exact amount. This document is what your bank needs.

Step 4: Work with an Integrated Bank

You can’t use just any bank. It must be a bank integrated with GeM’s SFMS system. Give them the UIN (Unique Identification Number) from your GeM request. The bank will then transmit the guarantee digitally—no physical paper needed.

Step 5: Auto-Verification

In most cases today, you don’t even need to upload a PDF. Once the bank sends the message, the GeM portal “listens” for it and verifies it automatically within 48–72 hours.

Benefits of ePBG for Your Business

It might feel like an extra step, but it’s actually a growth tool:

- Working Capital Efficiency: Instead of locking up lakhs of rupees in a cash deposit, you pay a small bank commission (often 0.5% to 2%). This keeps your cash free to buy raw materials.

- Paperless Speed: No more trips to the government office or expensive couriers.

- Better Seller Rating: Successfully closing an ePBG boosts your “Trust Score,” which helps you get more Direct Purchase orders in the future.

3 Common Rejection Mistakes And How to Avoid Them

As consultants, we see these errors daily. One tiny mistake can get your account suspended:

- The Typo Trap: If your GeM profile says “ABC Enterprises” but the bank writes “ABC Enterprise,” the system will reject it. The name must be an exact match.

- The 15-Day Deadline: You usually have exactly 15 days from the order date. If you miss this, you lose your EMD and can be blacklisted.

- Calculation Errors: Always ensure the validity includes that extra 60-day claim period. If your guarantee ends exactly on the delivery day, it is technically invalid.

Conclusion

Mastering ePBG in GeM is the mark of a professional contractor. While the system is designed to be automated, the technicalities of SFMS codes and bank mapping can be stressful when you have a deadline looming.

At Bidz Professional, we take the pressure off. From profile management to ensuring your bank guarantees are verified on time, we act as your dedicated GeM department.

Struggling with a rejected ePBG or need help with your first high-value bid? [Book a Free Consultation with our GeM Experts Today]